The carbon price is often referenced as a price driver for the UK Power and Gas market. In this article we explore the relevance of the carbon price in more detail with a particular focus on providing perspective to those who directly (or indirectly) procure Power and Gas for organisations that are not UK Emissions Trading Scheme (UK ETS) participants, and therebymay have less of a working knowledge of the important role of the carbon price.

Context (summarising the ETS)

But first, some context. On 1 January 2021 the UK’s ETS replaced the UK’s participation in the EU’s ETS. The EU ETS was set up in 2005 and is the world’s first (and remains the largest) international emissions trading system.

The UK scheme applies to energy intensive industries, power generation and aviation. Organisations covered by the scheme must have a greenhouse gas emissions permit for each tonne of reportable emissions. The term ‘reportable emissions’ refers to the total specified emissions in tonnes of carbon dioxide equivalent resulting from the regulated activities carried out at a particular installation.

The UK ETS focuses on activities involving combustion of fuels in installations with a total rated thermal input exceeding 20MW. There are various exceptions (such as the incineration of hazardous or municipal waste). Small emitters, hospitals and aircraft operators may also need further permits or an emissions monitoring plan.

The UK ETS follows the EU ETS by adopting a ‘cap and trade’ approach. A cap is set on thetotal amount of certain greenhouse gasses that can be emitted by sectors covered by the ETS.Participants receive free allowances but can also buy emissions allowances at auction, or on the secondary market. The allowances must be surrendered each year to cover reportable emissions. The cap is reduced over time, creating a pressure to reduce emissions.

The UK ETS also includes a Cost Containment Mechanism like the EU ETS, CCM, capping the cost based on historic prices to avoid sudden spikes, and this is being phased in over two years. The earliest this can be enacted now is November 2021 if the average prices in August, September and October would be consecutively over £50.37.

BEIS appointed the Intercontinental Exchange, Inc. (ICE) to hold the ETS auctions on behalf of the UK Government. Further details regarding the auction calendar and the spot and futures contracts can be found on the ICE.

What’s happening in the market?

The EU carbon price traded at below €10/tonne due to the excess supply of permits. However, two major bullish trends have driven the price to the recent €50/tonne mark. The first one began in March 2018 when the European lawmakers approved the new measure to reduce the number of permits for auction. The carbon price broke €20/tonne in September 2018 and fluctuated between €20 and €30/tonne until the end of 2020 when the second upward momentum began. The second trend was mainly driven by the bullish sentiment of post-pandemic recovery and the more ambitious carbon reduction goal set by EU Commission.

The increase in the carbon price also provides support to gas and power pricing. As one of the emissions reduction tools, a high carbon price helps motivate the switching from coal to gas generation. As a result, the high carbon price increases the demand for natural gas and the price as well. However, the actual number of the impact is difficult to quantify because it also depends on the tightness of gas supply.

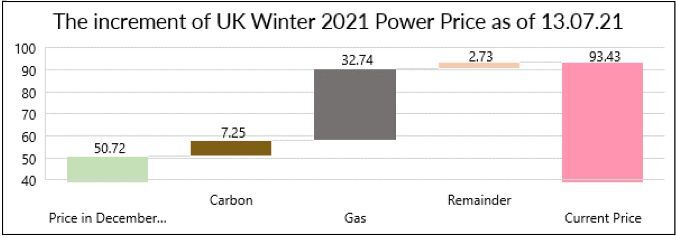

The impact on power pricing is more intuitive because the higher carbon price means the greater emission costs for coal and gas power plants. In addition, the carbon-motivated rise in the gas price pushes the generation costs higher. The chart below shows the decomposition of the increase in power prices attributed to the rise in carbon and gas. The increments are estimated based on a 50 percent efficiency gas fired power plant. As mentioned in the previous paragraph, a proportion of increase in the gas price can be related to the increase in carbon price, but the amount is not easy to estimate. However, this chart suggests at least 15percent of the increment in the power price is directly driven by the increment in the carbon price.

Conclusion

Carbon pricing is here to stay and we should not be surprised if the prices increase/remain high due to the mechanics of carbon pricing (reducing allowances year on year) and the pressure to deliver net zero – which is likely to result in further political pressure to reduce allowances.

The next time you see carbon prices increase, you should not be surprised if power and gas pricing follow suit. Power and gas pricing is clearly linked to carbon price, however there are a multitude of other drivers that must be considered.

Outlook for the next five years – we need carbon pricing to suppress carbon emissions (and coal in particular). It should be noted that political pressure to reduce carbon emissions may result in further bullish price moves for power and gas. Perhaps creating another argument to support hedging energy requirements further ahead than present. Of course, once the economy decarbonises energy production, the impact of carbon on the price of power can be expected to reduce, but new price drivers will emerge.

Authors: Clive Merifield, Business Development Director and Yueh Huang, Risk Systems Developer and Analyst at ZTP, the UK energy consultancy and software specialist (www.ztpuk.com)